The Cares Act Stimulus Package

The CARES Act Stimulus Package

You have all been hearing about the "Stimulus Package" being discussed in the news to provide economic relief due to the coronavirus pandemic.

It got finally and officially passed by Congress on Friday March 27, 2020 in the form of the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Everyone, of course, knows about the $1,200 "Stimulus checks" that will be coming to everyone (subject to income level phaseouts). That's because about 90% of people are estimated to qualify.

However, the $1,200 per person Stimulus Check is only 1 of 5 main areas of the CARES Act. You need to know about all five.

The $1,200 per person Stimulus Check is only 1 of 5 main areas of the CARES Act. You need to know about all five.

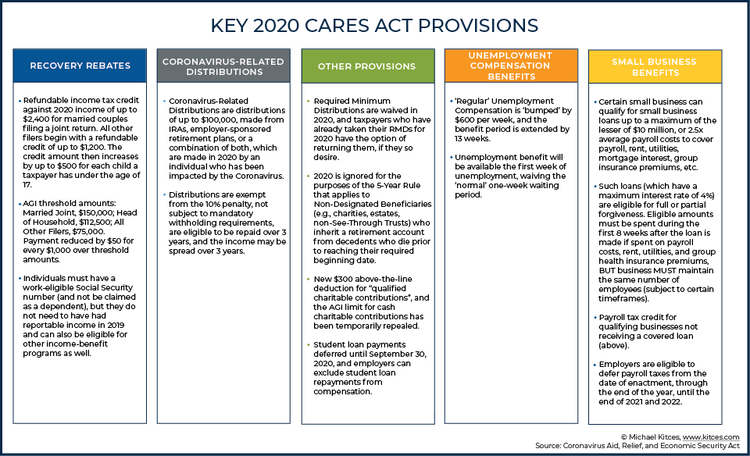

Here is an awesome infographic summary of the five key areas, from the Kitces.com blog (click source link below for more info). This blog post is a slimmed down, layperson-friendly summary of the more detailed explanation of the CARES Act found there, so kudos to the Kitces.com.

Source: Kitces.com

1. RECOVERY REBATES ("Stimulus Checks")

The $1,200 per person checks that everyone is going to get is actually a refundable credit for your 2020 tax return paid to you in advance.

Individual taxpayers will get $1,200. Married couples filing jointly will get $2,400. Additionally, there will be $500 per child under 17 claimed as a dependent on your return.

The income phase-outs for these begin at a certain level of Adjusted Gross Income (AGI): $75,000 for Single filers, $112,500 for Head of Household, $150,000 for Married Filing Jointly.

Note that the payments will be made to you based on your most recent tax return. That means if you haven't filed your 2019 tax return, the IRS will base the payment on your 2018 return.

This also means that if you were below the AGI thresholds above for the tax return the IRS bases the payment on, but you jump above those thresholds for 2020, you will have to pay some of that back when you file your 2020 return (for most people this would be in the form of a decreased refund, not an actual payment you end up having to make to the IRS).

2. CORONAVIRUS-RELATED DISTRIBUTIONS FROM RETIREMENT ACCOUNTS

If you have been affected by coronavirus - you, your spouse, or a dependent got sick from it, or lost your job or had reduced hours or had a negative impact to your business - you can withdraw up to $100,000 out of IRA's, 401(k)'s or other employer sponsored retirement plans, without the 10% additional tax penalty.

Note that you will still owe income taxes on withdrawals, but if you've lost income, you'll basically just be replacing the income you've lost if you've been laid off or temporarily furloughed. By default, the income reported for withdrawals is spread out over 3 years to lessen the tax impact, even though you take it all out this year. However, you can choose to have it all reported this year, which would be in your benefit if you will be a lower income level in 2020 due to coronavirus compared to future years when you are back to full-time work!

BUT, you also have up to 3 years to to recontribute the amounts you withdrew back to the retirement account(s) to avoid or recapture the taxes paid.

The typical 20% mandatory withholding for taxes will also not apply, though you should consider whether to still have that done if you think you will not repay the money and need to pay regular income taxes on it this year.

3. MISCELLANEOUS PROVISIONS

-If you are age 72, Required Minimum Distributions (RMD's) from pre-tax retirement accounts are waived for 2020. If you already took it out, you can put the money back in.

- Normally, you'd need to itemize your deductions to get any tax benefit for charitable contributions. However, there is a $300 cash charitable contribution deduction that everyone will be able to claim for 2020. Example: if you are in 22% federal tax bracket and have a 5% state tax rate, you will save $300 x 27% = $81 in taxes. This is very small - I wish it were higher.

- If you have direct federal student loans, all payments, interest, and charges are deferred until September 30, 2020. The additional great benefit is these "$0 payments" will count toward your PSLF timeline or your 20-25 year forgiveness timeline if you're on an Income-Driven Repayment plan.

- 401(k) loans have less restrictions - max loan amount is now $100k; 100% of your vested balance can be borrowed as opposed to previous limit of 50%; if you have any 401(k) loan payments you're making, all payments scheduled to be made in 2020 can be delayed for up to one year.

4. UNEMPLOYMENT COMPENSATION

- "Regular Unemployment Compensation" is increased by $600 per week, benefit period extended by 13 weeks beyond whatever the max period normally is under state law, and will be available right away, as opposed to the typical 1-week waiting period.

- Self-employed individuals - who normally aren't eligible for unemployment benefits - are now eligible for the next 39 weeks if they have entirely lost their revenues due to their line of work.

5. SMALL BUSINESS BENEFITS

This section is huge. If you are self-employed, own a small business, or work for a business with 500 or less employees, PAY ATTENTION. The best article I've seen so far on small business benefits is here, and the official PDF Summary from the US Chamber of Commerce can be found here.

- The Paycheck Protection Program (PPP) will allow almost all small businesses, self-employed individuals, and nonprofits to apply for emergency loan funding on very good terms. You can borrow up to 2.5 times your average monthly payroll costs (up to a limit of $10 million).

If you are self-employed, an independent contractor, or sole proprietor, you can get up to 2.5 times of your average monthly self-employment earnings over the last 12 months, with a limit of $100,00 of income used for the calculation.

Here's the huge part: your loan can be forgiven.

It can be forgiven up to the amount that you use the funds to keep up 1) payroll, 2) interest on a mortgage in the business, 3) rent, 4) utilities, 5) additional wages for tipped employees for the 8-week period following when you get the loan!

Any additional "true loan" amounts will have a max 4% interest rate. Loan term is up to 10 years. Payments can be deferred 6 to 12 months.

You can apply for these at any bank that participates in Small Business Administration (SBA) loans. However, do know that all the banks are scrambling to figure this new stuff out and may not be ready immediately to disburse these loans.

Already, I've seen a lot of banks setting up contact forms so you can be notified immediately whenever they're ready to start taking applications. Just google your bank (or any bank) and "paycheck protection program" until you see an option pop up over the coming days and weeks.

- Economic Injury Disaster Loans (EIDL's) have already existed previously, but now they've been opened up to almost everyone, as COVID-19 has been named an official qualifying national disaster. Again, this includes businesses with 500 or less employees but also sole proprietors and independent contractors. You just have to have been in business by January 31, 2020 to qualify.

The loan funds are typically 30 years, interest rates are 3.75% for small businesses, and the first monthly payment is deferred for a year.

But under the new EIDL's for COVID-19, they are providing a potential emergency $10,000 emergency cash grant advance that can be forgiven if it is spent on paid leave, maintaining payroll, covering increased costs due to supply chain disruption, mortgage/lease payments, etc. - mostly the same as above with a PPP loan. Additional funds will be paid off as a loan on the terms explained above.

You can apply for a COVID-19 EIDL straight through the SBA at this link. You may get the cash grant even if you don't qualify for any additional loan funds.

You can view the application for the Paycheck Protection Program here. They've announced that you can start applying for these on April 3 for small businesses, April 10 for self-employed.

You can apply for both EIDL and PPP loans, as long as they cover different expenses.

Remember, you can always apply, and choose not to take the loan! If there's a chance you think you might need it, you should apply ASAP because the systems are going to be slammed. Might as well get approved early and have the chance to accept within whatever time frame they give you if you end up needing it, rather than waiting to apply until funds are gone.

Feeling unsure about your financial future?

Schedule a 15-min Free Intro Call below, or get advice with our affordable Discovery Session.