How to Plan for "Unexpected" Expenses

THE MOST COMMON BUDGET-KILLER, HANDS DOWN, IS NON-MONTHLY EXPENSES. LEARN THE SIMPLE SOLUTION.

BUDGET FRUSTRATION

The most common experience I hear from people about budgeting goes something like this:

"Every time I've tried to set up a monthly budget, my whole plan ends up crashing and burning. I sit down and add up all my expenses, looking through the bank statement for my checking account. Then I try extremely hard to stay on top of my spending for a whole month, but before the month is over, something always comes up, and I always have a surprise expense that ruins the budget."

Well that sounds awful. Seriously. I once heard someone wisely teach, "all frustration comes from unmet expectations."

He was right. And it most definitely applies to budgeting. When we put efforts toward something, we expect to increase the probability of a certain desired outcome, right? So when the expected result doesn't occur, we get frustrated, and usually stop putting in the effort.

So what causes budgets to fail? I've spoken with hundreds of people about their budgeting experiences, and have noticed some common obstacles.

Most of the time, a budget that's "not working" comes down to a lack of execution more than anything. (budgets are more behavioral than financial). But besides that, there really is one common flaw in most budgets.

IT'S THE NON-MONTHLY EXPENSES THAT KILL YOU

When most people set up a budget, they do an extremely good job of setting up spending categories and limits for all their monthly expenses. Rent/mortgage, car payment, groceries, eating out, gas, insurance premiums, cell phone, internet, and utilities are accounted for.

This is where people take a mental shortcut. They assume that their monthly expenses make up just about all of their spending. Au contraire!

The most common budget-killer, hands down, is non-monthly expenses. I recently got to speak with U.S. News and World Report about it. These are the expenses that might happen every few months, twice a year, or even just once a year.

I'm assuming you can already think of a couple things that seem to "come out of nowhere" each year, even though you really know they're coming. Take Christmas, for example - we know it's a comin', but every December it's like we slip into a spending trance. When we finally regain our financial consciousness in January, we think, "I am so planning for that better next year," just to have December ransack us again a year later.

Beyond the obvious non-monthly expenses like Christmas and back-to-school shopping, though, are a host of other things that are honestly not easy to think of off the top of your head. And they add up to a lot more than you usually think.

In fact, with most people, I've seen that non-monthly, or "revolving" expenses often add up to 5% to 10% of your income! How in the world can you budget accurately if you're not even accounting for that much of your spending in the budget?

MAKING A REVOLVING EXPENSES TABLE

Here's the easiest way to start budgeting for the non-monthly/revolving/irregular expenses in your life.

The solution is simple. If you could add up all of these types of expenses that happen in a year's worth of time, you could get a monthly average to include in your budget that would cover these costs.

But simple does not mean easy. Performing an accurate gathering is hard. Here's how I'd recommend you do it:

MATERIALS NEEDED:

20-30 minutes

Your calendar of the last 12 months

Computer spreadsheet (or notebook and pen)

If you are brave, get the last 12 months of your checking account statements (or credit card statements, if you use them for your spending)

Ability to absorb the impact of realizing how much you spend

And guess what? If you don't want to make your own, here's a link to a template version already created for you! LUCKY

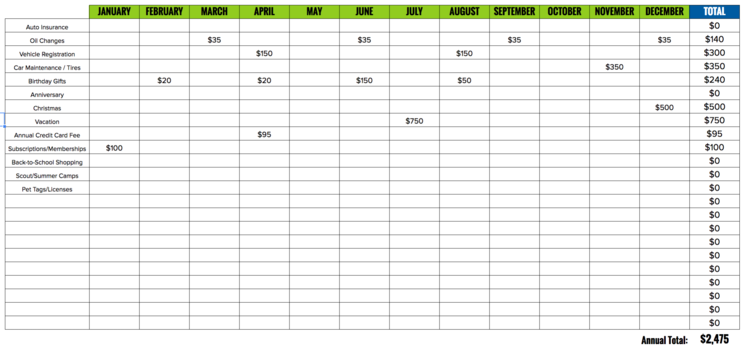

Okay. So all you need to do is create a table, at least 13 columns wide and with several rows (at least 15-20). Along the top, write the months of the year in each column.

As you go through each month, think of expenses that come up in your life. As you think of them, write them down along the left-hand side as the heading for each row, and the amounts of the expenses under the month they occur.

In the far right column, you're going to have a "Total" column to show the total annual amount you spend on a particular category.

Here's a snapshot example of my template to show you what I mean, which includes a lot of common revolving expenses pre-loaded.

The really important thing here is to try to capture as many of these things as you can. It does you no good if you forget things that happen every year that cost a significant amount.

Most likely, you won't be able to recall everything even with this table exercise, which is why I recommend you do two other important things as you fill out this table:

Scan through your calendar or personal planner of the last 12 months. Look for events and things you did that cost money and are likely to happen each year.

Review your last 12 months of spending via your checking account or credit card statements. This could take a million hours, so here's how you pare it down: quickly scan down the transactions and look for anything over a certain amount: say, $100. You're likely to catch several things throughout the year that you otherwise wouldn't remember.

Once you feel confident you've got a pretty comprehensive list, take a breather, and pat yourself on the back for a final round.

Because here is where you take a punch to the gut and realize why your budget never seemed to "work."

FIND YOUR MONTHLY AVERAGE AND PUT IT IN YOUR BUDGET

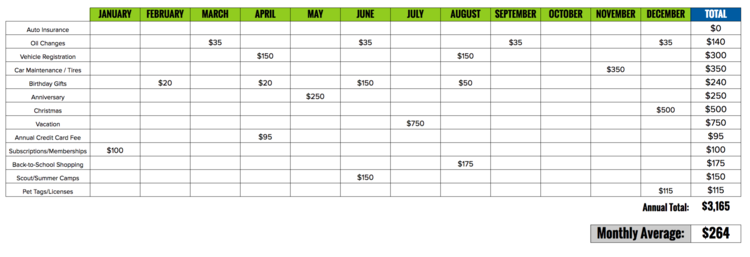

If you've filled out your Revolving Expenses Table thoroughly, you've got in front of you an estimate of the annual total for non-monthly expenses in your life.

After you get this grand total, divide by 12. This is the monthly average you should be setting aside to cover these expenses as they happen throughout the year.

I've filled out my example table with what I think could be pretty reasonable spending amounts for a family, though I only wrote down some of the most common ones.

As you can see, it's not too hard to come up with a monthly average of $264 or more! If you haven't budgeted for these things before, no wonder it always seemed like "surprises" came up.

The ironic thing though, is that the excuses we make about "surprise expenses" ruining the budget aren't really surprises most of the time. True surprises, those that are large expenses that truly can't be anticipated, are emergencies, and those should be covered by an emergency fund.

CONSIDER OPENING A SEPARATE ACCOUNT FOR YOUR REVOLVING EXPENSES

Once you have your monthly average, include it as a category in your monthly budget.

If living paycheck to paycheck is something you struggle with and you're trying to save and budget consistently, I'd highly recommend you actually use a second checking or savings account to save your monthly average amount in.

This will allow you to use your primary checking account to take care of your monthly bills and expenses like you've been used to, while reminding yourself that you have a different account that is planned in advance to take care of these large non-monthly expenses that drift in and out of your life across the year.

Take it one step further! - one incredible way to manage the non-monthly expenses in your life now is to use an online savings account with a sub-accounting feature.

If you're not familiar with sub-accounts, it's where you can actually split an online savings or checking account into different "pots" of money assigned a name or purpose instead of actually opening a bunch of little different accounts.

This means you could have $1,000 in a savings account, but split it into three "sub-accounts", such as a "Car Savings" sub-account of $500, a "Christmas" sub-account with $300, and a "Vacation" account with $200. And you can save into those "pots" separately.

All the research about savings psychology says that the more we split up and label our money by purpose, the better-disciplined we are to stick with it and not "raid" the money for something else.

If I can endorse my favorite one out there, it's definitely the Capital One 360 Savings Account. It allows you to split your account into 25 sub-accounts, by far the most of any savings account out there. And on top of that, it's got one of the highest interest rates in the industry at 0.75% APY.

IF YOUR BUDGET STILL ISN'T WORKING...

Even after all this strategizing and calculating, if your budget still isn't working then there may be something else at play. There's no shame about it, but managing your cash flow is more about behavior and discipline than it is about numbers and money.

It really may be helpful to get coaching from a professional. It's the same thing with personal health. If you have fitness goals but aren't reaching them even though you feel like you know what to do, it's a powerful process to account to someone else and get an objective view on how you can get the results you want in your life.

At the very least, ask a trusted friend or family member to be an accountability partner to help you stay within your budget. If that's uncomfortable, don't hesitate to reach out for my Cash-Flow Coaching service.

May your budgets no longer be broken!